Unwrapping DeFi: The Evolution of Tokens, Pools, and Vaults

An overview of all the fundamentals and how billion dollar token flywheels are built onchain

It’s become the opinion of many (including BlackRock’s CEO Larry Fink and Robinhood CEO Vlad Tenev) that “everything will be tokenized”. While this statement feels sensationalist and easy to dismiss, it’s driven by the promise of much higher distribution, liquidity, and returns onchain than can be obtained offchain.

But if you don’t really understand crypto (underneath the tokens), it probably just looks like copycat stablecoins and some mystery yield are driving the newest wave of adoption. It becomes very hard to discern the underlying patterns and strategies at play, even though it’s all technically transparent and open on the blockchain. It’s also very easy to think that wild token incentives are still driving the growth. But the 2020-2023 era of pure incentives farming and rotations is mostly out the door.

Decentralized finance (defi) has evolved with each crypto cycle, each time condensing hundreds of years of learning from traditional finance and economics into onchain protocols that are more efficient, trustless, and permissionless than their offchain counterparts. First came wrapping assets into tokens, then wrapping tokens together into pools that facilitate lending and trading, and now wrapping those pools with portfolio management and complex structured product protocols called vaults.

The spread math for where yield comes from is conceptually simple: you can stack yields through multiple tokens by placing them in pools and vaults, where you earn fees from anyone using those tokens for financial transactions:

The spreads already somewhat exist in traditional finance, but are only accessible to large intermediaries (banks/funds), who then give you that 1-cent yield in your Chase account. In crypto, it goes directly to you as the user/liquidity provider.

Both the opportunities and complexity in defi have gone up exponentially over the last five years - I want to take the time to unwrap it all for you. You must know these fundamental concepts and how they’re connected if you want to navigate defi:

Tokens: How billion-dollar token flywheels get built

Pools: How tokens plug into markets for trading/lending, and capital efficiency

Vaults: How liquidity is managed across pools for safer and higher yields

This article will cover more of the business “what” and “why” behind these concepts, rather than the technical “how” at the code level. All three of the above are operated using “smart contracts” that are deployed in sets that work together as a “protocol”.

@herd_eco will be hosting a workshop (and happy hour) in NYC this Thursday, October 30th, covering everything here and demoing our new product for creating/executing defi strategies and more.

Understanding the Token Flywheel

A token is a smart contract that usually follows a specific standard (ERC20, ERC721, ERC1155). For stablecoin and aspiring blue-chip tokens, there are two fundamental goals:

Sustainably manage the issuance and redemption of some asset, which gives it value

Create liquidity loops on top of token wrappers that expand the yield of the token and its prominence in the ecosystem

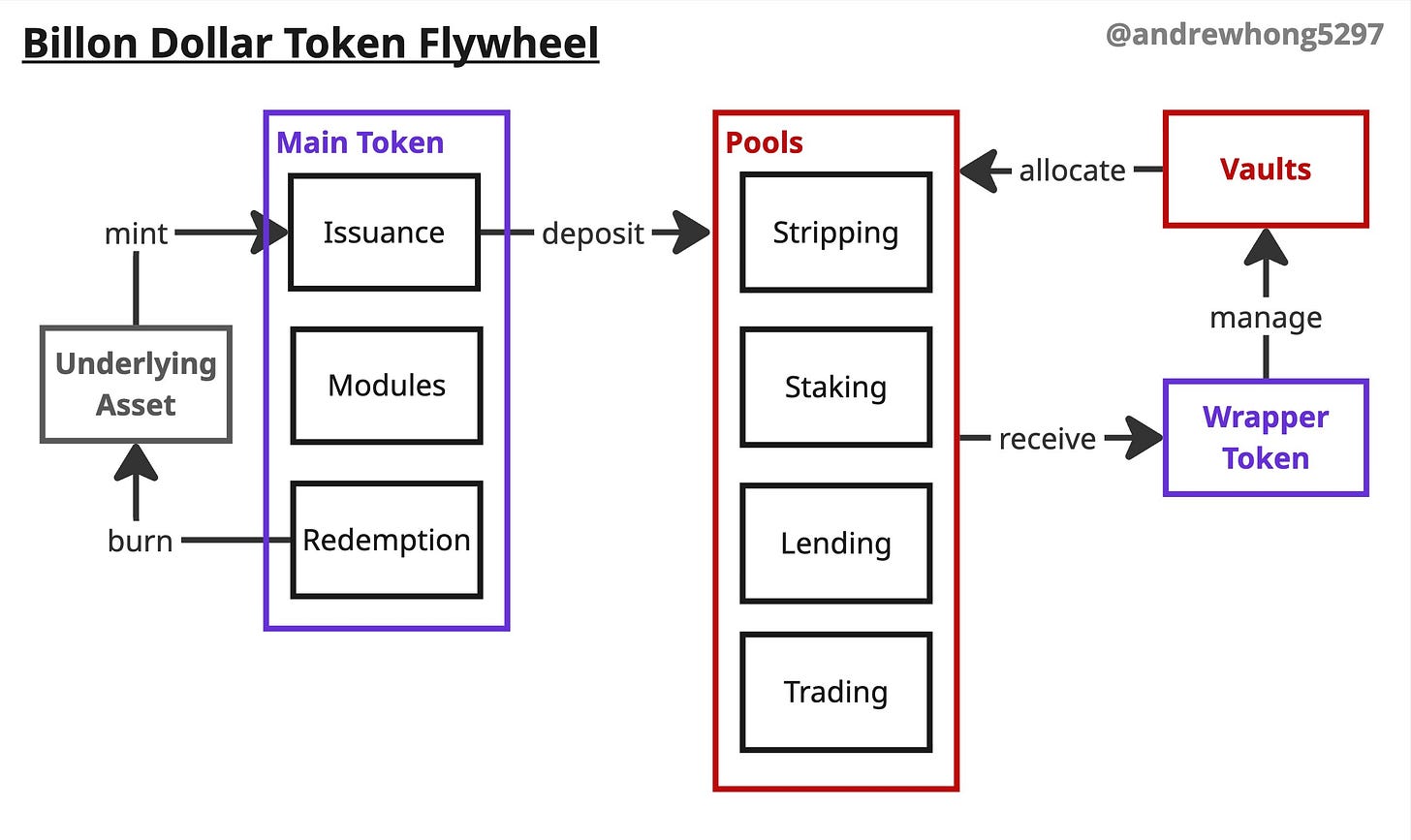

Any token that can satisfy that dual mandate ends up with a strong growth flywheel:

It’s hard to follow a token across many constantly changing protocols (contracts), leading most people to think of a token as a singular asset and engage only in surface-level trading discussions. That’s the wrong way to think about a token.

Let’s start by understanding how token issuance and redemption are managed. Tokens with actual “collateral” underlying them usually have code modules that delegate minting and burning functionality to another contract or allowlist.

Below are some primary categories of stablecoins (with their owner/deploy date):

Fiat Backed: USDC (circle, 2018), USDT (tether, 2017), PyUSD (paypal, 2023)

1:1 pegged redemptions, with treasury bills (T-bills) and other high-quality liquid assets held offchain as backing. Most of the time it’s offchain, but some do onchain redemptions (Bold, Liquity). Anyone can now launch something similar by pairing Bridge (acq by Stripe) for offchain issuance/reserve management and m0 for onchain liquidity/cross-chain token management (mUSD, Metamask)

Over-Collateralized: Dai (Maker/Sky, 2019)

Users “borrow” these tokens against collateral (originally ETH) they deposit, paying a borrow rate (stability fee) on the position. This pattern is called a collateralized debt position (CDP). Maker also offers a savings rate (akin to the Fed funds rate) on the token. The protocol can adjust both of these to maintain supply and demand and the soft $1 peg.

“Algorithmic” Stablecoins: Fei/Tribe (Fei Protocol, 2021), UST/luna (Terra, 2021)

Tries to use fancy dual-token tokenomics to uphold value and prevent a run on collateral. None of them worked, but they’re worth reading about.

Delta-Neutral: USDe (Ethena, 2023), Neutrl (Neutrl, 2025)

Users can deposit collateral (a specified set of tokens, such as ETH, USDT, etc.) to mint USDe, and Ethena takes a hedge against the collateral in open markets. This hedge is taking a short position on perps to earn money from the funding rate (which pays shorts most of the time) and protect against collateral value drops. Ethena has started offering a stablecoin launching service to manage both the issuance (partnered with Anchorage) and the yield onchain.

You can read more about these different types of tokens in this article. Generally, they have evolved to require more diverse sets of collateral with less over-collateralization (the delta-neutral strategies like Ethena are at 101% collateralization, versus Dai at around 270%). The algo stablecoin era is over due to the highly unpredictable nature of the fancy tokenomics model.

Next, let’s talk about wrapper tokens and their role in the flywheel. The canonical example of a wrapper token is WETH (Wrapped ETH), which turns the native ETH chain asset into an ERC20 token. This is necessary because most contracts are built around the ERC20 token standard, so converting to WETH simplifies the logic. You can also unwrap the WETH into ETH at any time, redeeming the underlying ETH. The amount of ETH is just tied to the amount of WETH, and has no ties to the wallet that originally wrapped it.

Wrapper tokens can be used by protocols to represent:

Interest/reward accrual, where the wrapper balance is automatically increased over time (like lending in Aave aTokens). Sometimes these are referred to as “rebasing” tokens.

Breaking down the underlying token into more modular pieces, such as splitting a yield token from Aave into principal and yield tokens (pendle). Or turning an NFT into a set of fungible tokens for fractional ownership (fractional.art).

Wrapping many underlying tokens at once, such as in a liquidity pool (Uniswap) when you need to represent both tokens in the pair or in a vault where the wrapper represents a share of all tokens in the vault contract (MetaMorpho).

I gave only one example protocol for the cases here, but these are all common patterns used by hundreds of protocols on Ethereum.

Because wrapper tokens follow ERC standards, they can often be reused in other protocols. Let’s examine USDe (the best new example of a strong token flywheel, with a $12bn market cap as of 2025/10/22). You could stake it for revenue share from Ethena’s protocol revenue to get sUSDe, split that yield (YT-sUSDe) and principal (PT-sUSDe) using Pendle, supply the principal token into a Morpho Market to earn on PT-sUSDe/USDC, or deposit into a Morpho vault that holds a more diversified set of positions (where the PT market position may make up 40% of the vault) to get MC_PTS. Don’t worry if this jargon doesn’t make sense to you - we’ll review the types of pools and actions behind these wrappers next. The flow looks like this:

USDe -(stake)-> sUSDe -(strip)-> PT-sUSDe and YT-sUSDe -(supply)-> PT-sUSDe/USDC -(vault)-> MC_PTS

You could consider all of the following wrappers as “extensions” of the base USDe token. They have some set of extended value and capabilities that the base token does not. When analyzing a token, look for all the wrappers around it to understand its full value and growth (easier said than done, I know).

How Pools Work and Make Money

In the examples above, the wrapper token returned represents a share of a “pool,” which is the contract into which the underlying token is deposited. Pools have become a blanket term for any contract that holds the token deposits of many different users at once, to be easily utilized by other users. It’s a peer-to-peer (P2P) system with a protocol that manages all ownership, math, and order-matching logic. The point of pools has always been to maximize capital efficiency for a set of financial orders/actions and to earn usage fees paid to users.

Here are the main types of pools you need to know, in the order that they were developed and became popular in the ecosystem:

Lending Pools (Money Markets):

Actions: Lend, Borrow, Loop

Wrapper: Rebasing token on either the lent or borrowed amount, based on the interest rate (floating).

History: CDPs (like over-collateralized DAI borrowing) kicked off basic onchain lending, with Aave and Compound launching pooled money markets in 2019 where users could lend and borrow from shared liquidity. The pools all have some interest rate curve that has some target “utilization rate” that defines the supply and borrow rates. The slope increases slowly until the target is reached, then becomes very steep until 100%. Each token also has a custom set risk profile which determines the Loan-to-Value and Liquidation-Loan-to-Value parameters - Risk profiles and LTV/LLTV are set on the collateral, defining how much you can borrow against it. From 2020 to 2023, we saw many attempts to make collateral management and liquidation auctions more efficient (see Rari isolated pools, Alchemix self-paying loans, and B-protocol pooled liquidations). This is also where “flash loans” came from, where you can borrow and repay a large sum of money within one block with zero collateral.

Key Trend: Tokens have to be manually added to these markets through governance proposals (with some exceptions), leading to some heavily contentious discussion about riskier assets like CRV and other bad actors attempting to game the pool systems. As the crypto space onboards more institutions and adds RWAs as collateral, the requirements and counterparty risks of pools will become even more sensitive. On the institutional side, you don’t want to mix KYC and non-KYC funds so you end up with allowlisted pools like Aave Horizon RWA. For accessing a wider range of institutional borrowers and enabling undercollateralized lending, we see products taking normal deposits into a pool but then lending out to borrowers through privately managed and credit scoring/slashing methods (Maple and 3Jane respectively). This will be interesting to watch as we see thousands of stablecoins and RWAs get launched, because you will have this tension between issuers wanting to access the yield benefits of all these pools by being added in, but also the protocols managing the pools have to satisfy the institutional requirements which means being strict about the asset classes and participants allowed.

Trading Pools (Liquidity Pools)

Actions: Add/Remove Liquidity, Swap

Wrapper: LP tokens, which redeem for an equal share of the underlying pool tokens plus trading fees earned (usually configured between 0.05%-1% of volume). This pool token balances may have changed since the deposit, leading to impermanent loss (it’s permanent).

History: What started as a two-token pair with Uniswap’s xy=k curve to create an automed market maker (AMM) has evolved mostly in math and the granularity of the price curves (exchange rates) to improve price impact and idle liquidity in pools. There have been stablecoin-specific curves, weighted 8 token curves, concentration curves to manage liquidity in specific tick ranges so that you can control impermanent loss, and most recently pool hooks to allow more composability with other protocols before/during/after each swap. Unlike lending pools, liquidity pools have always been permissionless, so anyone can add any tokens to them (because pairs don’t affect each other in a “collateral” sense). A lot of focus in the last year has also been on token launchpads, which are heavily influenced by the trading curve tied to the initial liquidity. There have been many new protocols like pump.fun, clanker, doppler (used by zora) with unique liquidity bootstrapping or bonding curves that give a token more initial momentum, price discovery, and/or anti-sniper mechanisms.

Key Trend: Both lending and liquidity pools aim to minimize idle capital, so new protocol versions have introduced extensions that enable more seamless capital transfer between the two. Some examples are Balancer boosted pools which keep idle liquidity in a yield-bearing pool (like Aave), or Uniswap hooks that allow protocols like Eulerswap to push liquidity from their lending pool into Uniswap for JIT swaps. This kind of rebalancing is becoming more popular within each pool, too, with protocols like Arrakis managing concentrated liquidity price targets and Morpho’s PublicAllocator for balancing the target rate across lending pool markets.

There’s a lot more to be said on the constant debate about how orders are matched for trading pairs, be it AMMs, CLOBs, intent market makers, perp DEXs, etc. But those differences aren’t really relevant to the point of this article. For another time!

Staking Pools (Insurance Funds)

Actions: Stake, Lock

Wrapper: Some token with “s” in front of it, usually earning some split of protocol revenue.

History: With staking, you are usually putting up your tokens to be potentially slashed (losing stake) in a black swan/negative event. This can range from staking ETH on a validator and getting slashed if you fail a block proposal, to absorbing bad debt from lending pools like Aave. Sometimes it’s just meant to be a lockup to prevent immediate selling, so supply is more stable - Ethena does this with USDe -> sUSDe. In all these cases, the protocol will often share some revenue directly with stakers for taking on the extra risk/illiquidity.

Key Trend: Staking has always been and will continue to be a core component of maintaining protocol security and providing initial yield to users. It’s the simplest of the pools here, but core to the token flywheel. You might hear people say “restaking” which just means using an existing blue-chip token to stake in a different protocol (instead of issuing a protocol native token) - it’s the same staking mechanics, don’t overthink it.

Incentivized Pools (Gauges)

Actions: Vote

Wrapper: was common to add “ve” to the token being staked, starting with Curve (veCRV). You earn the protocol token as yield, on top of the usage fees from liquidity/lending pools.

History: Let’s say you’re a token issuer and you have all these lending/liquidity pools with somewhat similar yields. How can you push users to choose your tokens’ pools over another? By adding token incentives that can be earned, of course! Many protocols (regardless of if it’s a token, pool, vault, etc) will launch a protocol token for governance/ownership purposes. These can then be used to pay out liquidity providers over time (called “emissions”). So a pool protocol (like Aave) can emit tokens for deposits into their pools, and then Ethena could add ENA incentives on top of specifically the aEthUSDe Aave pool for more rewards. Emission pools emerged as a way to direct token incentives to specific liquidity or lending pools, helping protocols compete for user liquidity. Curve pioneered this model with vote-escrow (ve) mechanics, allowing tokenholders to lock CRV and vote on where emissions should flow (to boost their own rewards) in “gauges”. There were then many pooling layers built on top to fight for voting majority in the underlying protocol pools - such as Yearn, Convex, Tokemak, Butterfly, and Olympus. This happened in tandem with the airdrop and vampire attack era, where teams like Sushiswap would fork other protocols and do heavy incentives to drain usage from competitors. This is where the 1670% yields came from.

Key Trend: It was an ugly but notable part of defi pool history, incentivized pools still exist but are much tamer than before. See aerodrome and pendle for some modern examples of incentive pool voting. The good news is that a lot of the technology they built transitioned well into “vaults” for more serious defi strategy management. Yearn and Tokemak (Auto Finance) are two that have stuck around the post-farming era.

Strategy Pools (Vaults)

Actions: Deposit, Redeem

Wrapper: shares of the vault token, as a percentage. The percentage ensures you can automatically redeem any earned interest on any tokens in the vault.

History: Vaults largely emerged from the emissions- and incentive-based farming era mentioned above. They’re now standardized with ERC4626, and are fully focused on efficient allocation and rebalancing across pools. I’ll talk a lot more about vault structures in the next section instead of yapping here.

Structured Pools (Structured Finance)

Actions: Strip, Split

Wrapper: Really can be anything that represents a component of the underlying token (and what it owns/earns). The goal is to create a more liquid wrapper token. Commonly “L” prefixed, such as LSTs, LYTs, LRTs, Liquid lockers etc.

History: These are pools that take in an asset and restructure it into smaller components. Breaking tokens down creates more opportunities for wrapper reuse. Pendle has been the most successful example of this with principal (PT) and yield (YT) tokens stripped from yield-bearing tokens being implemented all across defi. There have been many attempts at “fractionalization” as well during the NFT cycle in 2022, such as turning NFTs into fungible shares for fractional ownership.

Key Trend: As defi becomes more mature, we can expect to see many more protocols that convert traditional structured finance products into their crypto native counterparts. This kind of pool is the most technically complex to implement and usually tough to communicate and coordinate with users.

Vault Management and Yield Strategies

Many of these pools have yields that are isolated from one another at a protocol level but dependent through wrappers. How can a user easily manage all these wrappers and pools to optimize yield? The answer lies in “strategies”.

From 2019-2022, users had to discover and manage strategies across tokens and pools individually. Some popular strategies included “levering up” on positions, for example in a lending pool if you deposited $100 of ETH you could borrow $80 of USDC, swap that into ETH, and deposit it again to earn extra yield. You’re taking on the risk of getting liquidated if ETH price falls below the LTV, but otherwise earning yield (assuming the USDC borrow rate < ETH supply rate). Getting into the various farming vaults often required going through a set of swap/pool/stake steps across multiple transactions. To get around this, solidity developers would aggregate the function calls in a separate contract so that a user could sign just one transaction to enter some position - this was called a “zap” (first seen in defi zap). Products like Zapper, Instadapp, and Defisaver then built out numerous contracts for zapping into each new protocol that popped up, like a game of whack-a-mole. These are not simple to deploy either, given the security risks - you can read about Defisaver’s architecture for a glimpse of the complexity. As one would expect, it became impossible for any one team to keep up with every new defi protocol/version/vault. The retail products for stuff like this today do have 10x better UX than in 2020 - everything from leverage management with the products mentioned above or portfolio/ETF management with products like Reserve and Glider.fi.

So, naturally, it makes sense to have users deposit into a vault that manages different zaps themselves - and just call them “strategies” instead. Most vaults today follow the ERC4626 standard, which consists of:

A user who deposits some token into the vault to get a vault wrapper token representing a percentage share of all tokens in the vault, where that share includes any yield earned in the vault that can be redeemed anytime.

Functions in the vault for managing “strategies” that move around tokens and positions (sometimes these functions are called “adapters” since they have custom logic that needs to be adapted to specific protocols and pools).

A curator who defines and executes the strategies over time and adds/removes tokens.

As with any ERC standard, there end up being many extension standards on top of the base standard (ERC4626), such as ERC7540. These extensions aren’t always made into a standard, and may be protocol specific such as the adapters in Morpho vaults v2.

The vault strategies right now are pretty similar: a vault supplies tokens to a set of lending/liquidity pools. Most of them don’t take on much/any leverage. For the more manually managed vaults, the best example is how Morpho curators work by managing caps and flows across different markets. Yearn and Lagoon are other great examples. Then there are more protocol automated vaults like Sommelier and Beefy. Vaults works for trading strategies too, see Hyperliquid Vaults. We’re in a period right now where teams are figuring out how to build the most flexible vaults (access the most pools/tokens) and execute and manage strategies within them.

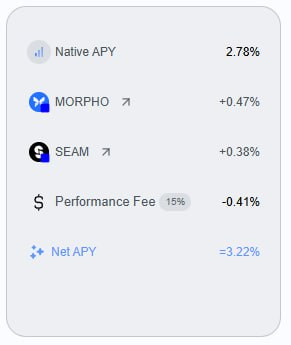

The yield structure for the user (depositor) looks something like this (Morpho vault):

The “native fee” comes from underlying lending pool utilization across allocations, the MORPHO and SEAM tokens are emissions on top, and the vault curator takes a hefty 15% performance fee.

Now, vaults do have a transparency problem, in that users don’t always understand what strategies are actually underneath them. That’s something we’re hoping to help with using Herd, soon. Be careful when depositing into high-yield vaults.

Now tying everything we’ve learn back together in the token flywheel using the Ethena stablecoin USDe as the example, we get a flow diagram like this:

Every pool, wrapper, and vault adds to the value of the base USDe token, and as Ethena grows, the ecosystem will push for more complex pools and vaults to be built on top. All this creates more demand for minting the USDe token.

Naturally, the token issuer wants to own as much of this flywheel yield as possible. So it’s becoming more popular for the token issuer to offer vaults of their own, see Perena and Midas (tbd on how safe these are, I have just seen them mentioned here and there).

Concluding Thoughts

If you made it this far - first off, props for actually reading in the age of AI - you should now understand the history and growth of defi much better. Next time someone talks about a token or pool, you’ll know how to traverse the web of related tokens, pools, and vaults to have a much more nuanced discussion.

There is a growing problem with executing transactions across all these different strategies. Herd is working on a new standard and AI for easily composing these transactions, stay tuned for the follow-up article on our new product (or come to our event in NYC this Thursday, Oct 30th to see the live demo).

I’ll also note that I’ve left out many lower-level concepts and nuances related to token, pool, and vault operation risks. Many of these risks revolve around how to price a token across protocols, getting into the oracle problem (aggregating off-chain price feeds/calculations onchain as a source of truth for token prices) - I recommend searching up the oracles listed here. As well as the dark forest of MEV/sniper bots that run behind the scenes. If people enjoy this article, I can do another one on the operational “how” side of defi that covers these deeper and more difficult topics.

I’m always open to chat about any of this if you dm me - be it questions, critiques, or ideas!

love this so much, hope can read “how” version soon. thanks for the articles

great summary