How To Analyze Any Crypto Token In Five Minutes

Using thirteen charts to understand the Optimism token (or any erc20 token), with concepts like momentum, liquidity, and distribution.

This video/article is dedicated to Optimism - thanks to their Retroactive Public Goods Funding program, Web3 Data Degens has now earned 9.6k in OP tokens to continue education work! You can deploy your own L2 EVM chain using the OP Stack by using Conduit.

This is not financial advice, I’m using the OP token purely for analytics purposes.

A quick primer of crypto tokens

Crypto tokens in this context are fungible tokens that use the ERC20 standard. These tokens are smart contracts on EVM that can be used for a variety of functions, including governance, membership, and DeFi applications.

In governance, tokens can be used for voting on proposals and decisions within decentralized autonomous organizations (DAOs).

In membership, tokens can represent membership in a particular organization or community, granting access to exclusive content or services.

In DeFi, ERC20 tokens are used in various financial services, such as decentralized exchanges, lending and borrowing platforms, stablecoins, and much more.

Their standardization has made them easy to integrate and widely adopted, allowing for interoperability across various Ethereum-based platforms.

A framework for token analysis

Now, what does that mean for doing data analysis on the tokens? It means that there are tons of reasons that people might be transferring tokens - so you really need as much context as possible. If you only look at the token’s price or trading charts, you are going to be missing 99% of the picture.

I like to build up my context of a token in three parts:

Momentum: has there been a large shift in how many addresses are transferring the token? Who is driving those movements - whales, insiders, outsiders?

Liquidity: where are people getting their tokens from - DEX, CEX, other wallets, special contracts? Where are people depositing their tokens - staking, liquidity pools?

Distribution: What does the distribution of token holders look like, and how fair is it?

If you understand these three elements, then you should have enough context to now do further analysis and digging. Like most of my dashboards, the goal here is to help equip you to ask the right questions when doing your own analysis.

Here’s the link to the dashboard, with the OP token on Optimism inputted. I’ve done a full walkthrough of how I interpret all the charts in the short video below:

Below are some of the charts in the dashboard that helped me get a quick understanding of the OP token:

First, I noticed that the number of wallets interacting with the token has increased consistently, with new and accumulating wallets driving the way (signifying a healthy community).

since the token launched last year activity was first slow but has grown exponentially as the L2 narrative gained steam.

Next, I want to understand where tokens are coming from. In the chart below, you can see that most months half of token liquidity is coming from DEX/CEX. But there are also quite a few other contract sources, such as Rubicon, Premia, and Sonne Finance. August 2022 had a lot of multisig activity, so there were probably a bunch of grant distributions that month.

It’s useful to study DEX liquidity and volumes as well, so here’s a quick chart to show you how competitive the DEX market is for the OP token. We can see Uniswap v3 and Velodrome fighting for the top spot right now, both likely have ongoing incentive programs,

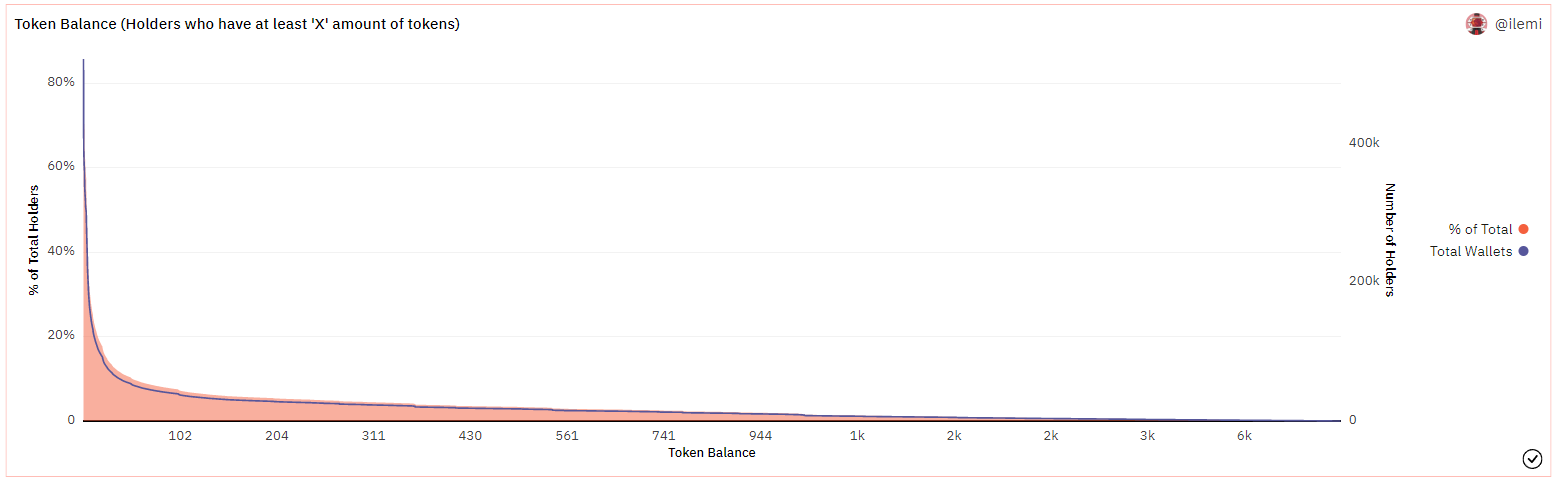

The last step here is just to understand how fairly distributed the token is. Given it’s a governance tokens with over 500k wallet’s holding the total supply of 4.29 billion OP tokens, the exponential distribution is not surprising.

50% of wallets hold less than 4 OP tokens - this might be a sign of high Sybil presence, low airdrop amounts, or some other sort of dapp kickstart program. It’s also worth noting that

The “Average Holdings” chart shows that this pattern has been consistent for quite a few months now too. It is interesting how quickly the distribution changed since the first airdrop - I’m sure there is a story behind this shift.

Again, the dashboard can be found here. Give it a star if you liked it!

If you’ve have any dashboard suggestions or have just found some interesting token pattern - please let me know by dming me or just tagging me on Twitter with what you’ve found!

Make sure to stay subscribed as well - I have some fun GPT x Web3 data content coming really soon.